各种参数

此处整理,借贷协议AAVE的借贷利率相关参数:

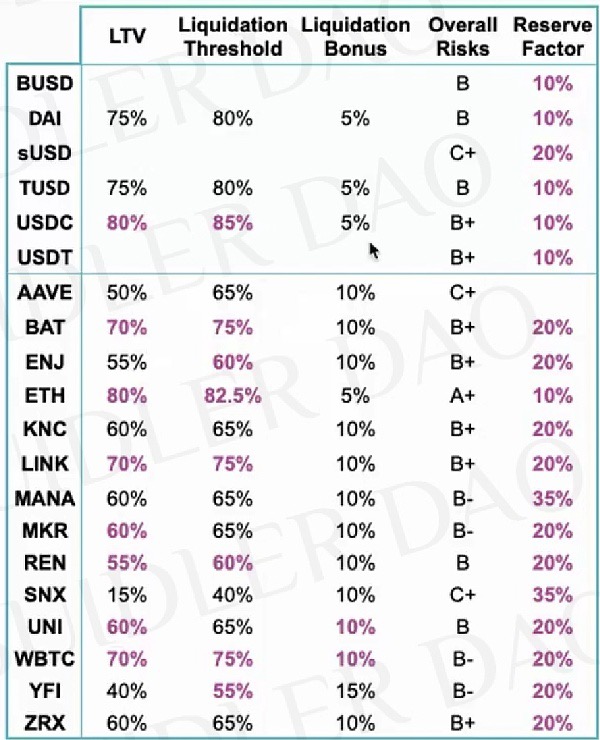

AAVE中的LTV

- AAVE中的LTV=Loan-To-Value=贷款价值

- ~= Collateral Factor=抵押率

- 举例

- 存入100块,能贷出多少钱

- 举例:存入100,能贷出75,就是:LTV=75%

- 存入100块,能贷出多少钱

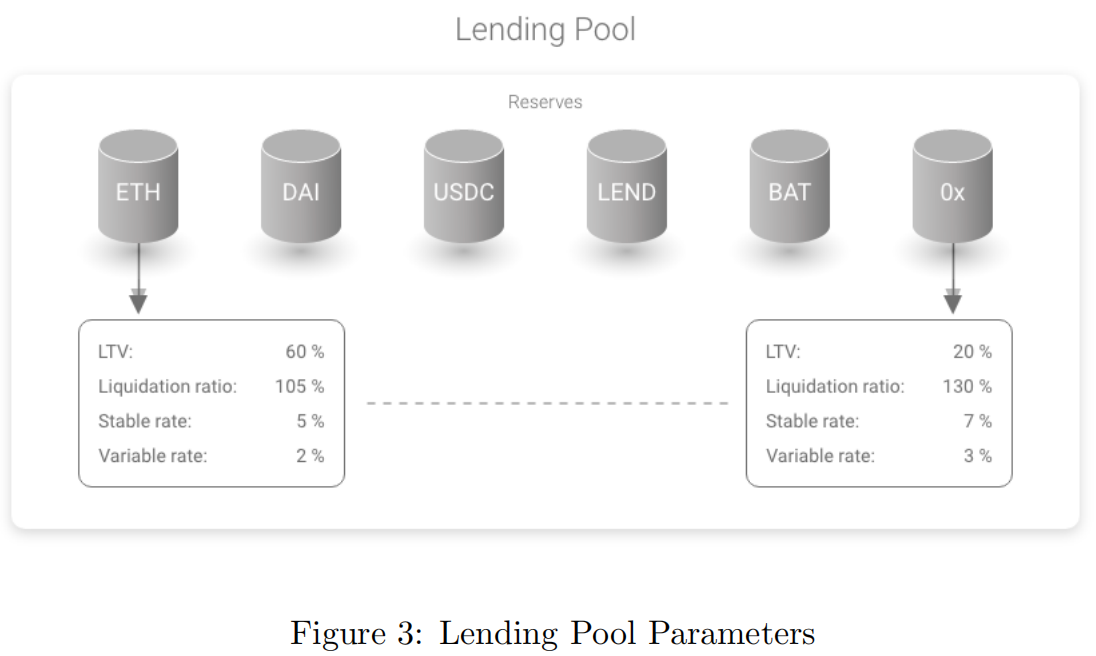

- 借贷池参数

- 举例

Rv0=基础可变借贷利率

- R(v0) = Base Variable Borrow Rate = 基础可变借贷利率

- 常数为Bt = 0。以射线表示

- Constant for B(t)=0. Expressed in ray

- 相关代码

- baseVariableBorrowRate

- 常数为Bt = 0。以射线表示

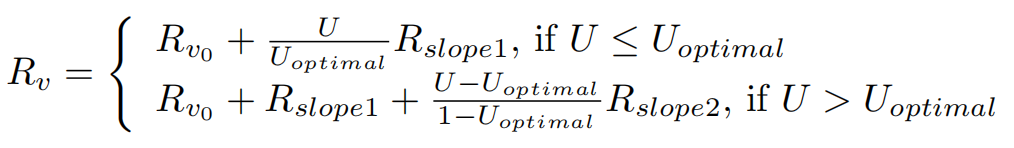

Rv=可变借贷利率

- R(v) = Variable Borrow Rate =可变借贷利率

- 公式

- 此利率模型可校正主要利率:

- 当 U = 0: R(v) = R(v0)

- 当U = Uoptimal:R(v) = R(v0) + Rslope1

- 高于 Uoptimal:考虑到资金成本,利率急剧上升

- 公式

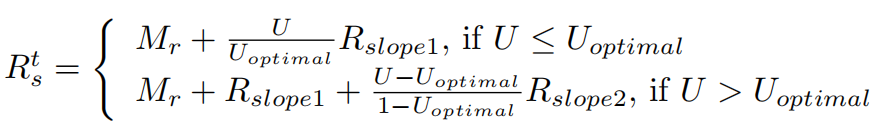

Rs=稳定借贷利率

- R(s =) Stable Borrow Rate = Current Stable Borrow Rate = 稳定借贷利率

- 计算公式

- 说明

- M(r):平均市场贷款利率

- the average market lending rate

- R(slope1):在非最优条件下的利率,斜率随着U的增加而增加

- the interest rate slope below Uoptimal, increases the rate as U increases.

- R(slope2) :超出非最优的利率,斜率随着U与非最优之差的增大而增大

- the interest rate slope beyond Uoptimal, increases as the difference between U and Uoptimal increases.

- U:是利用率

- is the utilization rate.

- M(r):平均市场贷款利率

- 注意

- Rs不会影响现有的稳定利率头寸-这只适用于新开的头寸

- R(s) does NOT impact existing stable rates positions – this is applied only to new opened positions.

- Rs不会影响现有的稳定利率头寸-这只适用于新开的头寸

- 以射线表示

- Expressed in ray

- 计算公式

Rslope1=斜率1

- R(slope1) = Interest Rate slope below U(optimal)

- 常数,当U <Uoptimal 时,表示利率与利用率的比例。以射线表示

- Constant representing the scaling of the interest rate versus the utilization, when U < U(optimal). Expressed in ray

- 常数,当U <Uoptimal 时,表示利率与利用率的比例。以射线表示

Rslope2=斜率2

- R(slope2) = Interest Rate slope above U(optimal)

- 常数表示利率与利用率的比例,当U≥ U(optimal)。以射线表示

- Constant representing the scaling of the interest rate versus the utilization, when U ≥ U(optimal). Expressed in ray

- 常数表示利率与利用率的比例,当U≥ U(optimal)。以射线表示

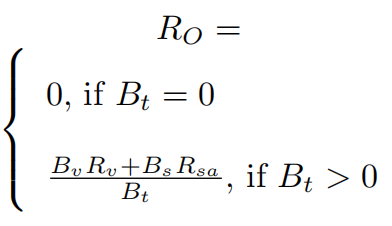

Ro=总体借贷利率

- R(o) = Overall borrow rate=总体借贷利率

- 公式

- 说明

- 准备金的总借款率,以总可变借款Bv与总稳定借款b的加权平均值计算

- Overall borrow rate of the reserve, calculated as the weighted average between the total variable borrows Bv and the total stable borrows Bs

- 准备金的总借款率,以总可变借款Bv与总稳定借款b的加权平均值计算

- 公式

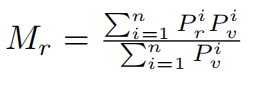

Mr=平均市场借贷利率

- Mr=平均市场借贷利率=average Market lending rate

- 公式

- 参数说明

- i:平台个数

- M(r:)平均市场借贷利率

- P(r)(i):借贷利率=贷款利率

- P(i)(v):借贷量

- 含义解释

- 基本稳定借款利率,以射线表示

- 市场价格将每日更新,最初由Aave

- 公式

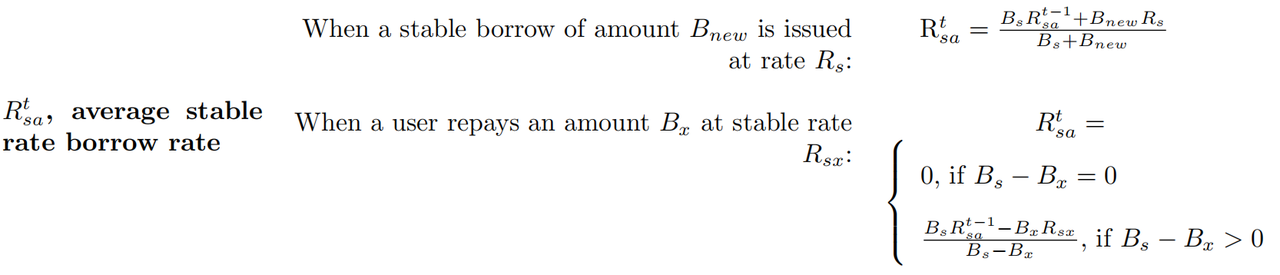

Rsa=平均稳定借贷利率

- Rsa = Average Stable rate borrow rate=平均稳定借贷利率

- 公式

- 说明

- 详见函数

- decreaseTotalBorrowsStableAndUpdateAverageRate()

- increaseTotalBorrowsStableAndUpdateAverageRate()

- 以射线表示

- Expressed in ray

- 详见函数

- 公式

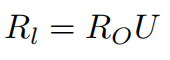

Rl=当前流动性比例

- R(l)=current Liquidity rate=当前流动性比例

- 公式

- 说明

- 总借款利率R(O)与利用率U的函数

- Function of the overall borrow rate RO and the utilization rate U

- 总借款利率R(O)与利用率U的函数

- 公式

Bx=PB=用户本金借款余额

- User Principal borrow Balance=用户本金借款余额

- 旧=AAVE V1

- 变量:B(x)

- 说明

- 当用户打开借贷头寸时存储的余额。在多次借款的情况下,复利每次累积,它成为新的本金借款余额

- Balance stored when a user opens a borrow position. In case of multiple borrows, the compounded interest is cumulated each time and it becomes the new principal borrow balance

- 当用户打开借贷头寸时存储的余额。在多次借款的情况下,复利每次累积,它成为新的本金借款余额

- 新=AAVE V2

- 变量:PB(x)

- 说明

- 当用户打开借贷头寸时存储的余额。在多次借款的情况下,复利每次累积,它成为新的本金借款余额。

- 旧=AAVE V1

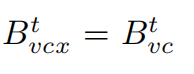

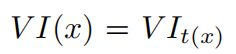

Bvcx=VI=用户累计浮动借款指数

- B(t)(vcx)=user Cumulated Variable borrow indeX=用户累计可变利率借款指数 = 用户借款累积指数=用户累计浮动借款指数

- 旧=AAVE V1

- 公式

- 说明

- 特定用户的变量借款指数,在用户打开(新增?)变量借款头寸时存储

- Variable borrow index of the specific user, stored when a user opens a variable borrow position

- 特定用户的变量借款指数,在用户打开(新增?)变量借款头寸时存储

- 公式

- 新=AAVE V2

- 公式

- 说明

- 特定用户的可变借款指数,在用户新开可变借款头寸时存储

- 公式

- 旧=AAVE V1

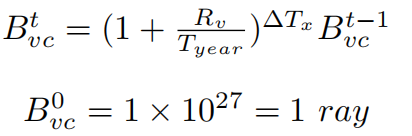

Bvc=VIt=累计可变利率借款指数

- B(t)(vc)=Cumulated Variable Borrow index=累计可变利率借款指数 = 借款累积指数=累计浮动借款指数

- 旧=AAVE V1

- 公式

- 说明

- 由变量借款Bv按利率Rv累积的利息,在借款、存款、偿还、赎回、切换利率、清算事件发生时更新

- 公式

- 新=AAVE V2

- 含义

- 从池子首次发生用户操作时,累计到现在,每单位借款债务,共变成多少债务

- 变量借款VB在一段时间∆T内以可变利率V R累计的利息

- 公式

- 说明

- 在发生借款、存款、偿还、赎回、掉期、清算事件时更新

- 这里使用复利公式计算利息,每次存钱、取钱、借钱、赎回、清算操作等动作

- 因为在链上计算成本高,AAVE使用了泰勒展开式模拟这个公式,为了避免昂贵的求幂,使用二项式近似进行计算。

- 不举例子了

- 任务每次计算复利的时候,VIt都会大一点点,跟流动性累计指数相似。

- 注意这里的复利周期是每秒计算的

- 代码

- CoreLibrary

- 储备和用户数据的数据结构

- CoreLibrary

- 含义

- 旧=AAVE V1

struct UserReserveData {

//principal amount borrowed by the user.

uint256 principalBorrowBalance;

//cumulated variable borrow index for the user. Expressed in ray

uint256 lastVariableBorrowCumulativeIndex;

//origination fee cumulated by the user

uint256 originationFee;

// stable borrow rate at which the user has borrowed. Expressed in ray

uint256 stableBorrowRate;

uint40 lastUpdateTimestamp;

//defines if a specific deposit should or not be used as a collateral in borrows

bool useAsCollateral;

}

struct ReserveData {

/**

* @dev refer to the whitepaper, section 1.1 basic concepts for a formal description of these properties.

**/

//the liquidity index. Expressed in ray

uint256 lastLiquidityCumulativeIndex;

//the current supply rate. Expressed in ray

uint256 currentLiquidityRate;

//the total borrows of the reserve at a stable rate. Expressed in the currency decimals

uint256 totalBorrowsStable;

//the total borrows of the reserve at a variable rate. Expressed in the currency decimals

uint256 totalBorrowsVariable;

//the current variable borrow rate. Expressed in ray

uint256 currentVariableBorrowRate;

//the current stable borrow rate. Expressed in ray

uint256 currentStableBorrowRate;

//the current average stable borrow rate (weighted average of all the different stable rate loans). Expressed in ray

uint256 currentAverageStableBorrowRate;

//variable borrow index. Expressed in ray

uint256 lastVariableBorrowCumulativeIndex;

//the ltv of the reserve. Expressed in percentage (0-100)

uint256 baseLTVasCollateral;

//the liquidation threshold of the reserve. Expressed in percentage (0-100)

uint256 liquidationThreshold;

//the liquidation bonus of the reserve. Expressed in percentage

uint256 liquidationBonus;

//the decimals of the reserve asset

uint256 decimals;

/**

* @dev address of the aToken representing the asset

**/

address aTokenAddress;

/**

* @dev address of the interest rate strategy contract

**/

address interestRateStrategyAddress;

uint40 lastUpdateTimestamp;

// borrowingEnabled = true means users can borrow from this reserve

bool borrowingEnabled;

// usageAsCollateralEnabled = true means users can use this reserve as collateral

bool usageAsCollateralEnabled;

// isStableBorrowRateEnabled = true means users can borrow at a stable rate

bool isStableBorrowRateEnabled;

// isActive = true means the reserve has been activated and properly configured

bool isActive;

// isFreezed = true means the reserve only allows repays and redeems, but not deposits, new borrowings or rate swap

bool isFreezed;

}

- 更新

- 与v1版本不同的是,在更新储备状态时会将一部分产生的利息收入存入金库(treasury)中,具体的比例由储备的reserveFactor(configuration字段的一个值)来确定

/**

* @dev Updates the liquidity cumulative index and the variable borrow index.

* @param reserve the reserve object

**/

function updateState(DataTypes.ReserveData storage reserve) internal {

uint256 scaledVariableDebt =

IVariableDebtToken(reserve.variableDebtTokenAddress).scaledTotalSupply();

uint256 previousVariableBorrowIndex = reserve.variableBorrowIndex;

uint256 previousLiquidityIndex = reserve.liquidityIndex;

uint40 lastUpdatedTimestamp = reserve.lastUpdateTimestamp;

(uint256 newLiquidityIndex, uint256 newVariableBorrowIndex) =

_updateIndexes(

reserve,

scaledVariableDebt,

previousLiquidityIndex,

previousVariableBorrowIndex,

lastUpdatedTimestamp

);

_mintToTreasury(

reserve,

scaledVariableDebt,

previousVariableBorrowIndex,

newLiquidityIndex,

newVariableBorrowIndex,

lastUpdatedTimestamp

);

}

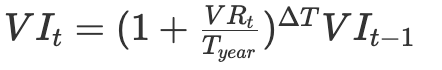

Bxc=用户复利借款余额

- B(x)(c)=user Compounded borrow Balance=用户复利借款余额

- 旧=AAVE V1

- 公式

- 说明

- 本金Bx加上累计利息

- Principal Bx plus the cumulated interests

- 本金Bx加上累计利息

- 公式

- 新=AAVE V2

- 代码

- 旧=AAVE V1

struct RepayLocalVars {

uint256 principalBorrowBalance;

uint256 compoundedBorrowBalance;

uint256 borrowBalanceIncrease;

bool isETH;

uint256 paybackAmount;

uint256 paybackAmountMinusFees;

uint256 currentStableRate;

uint256 originationFee;

}

function repay(address _reserve, uint256 _amount, address payable _onBehalfOf)

external

payable

nonReentrant

onlyActiveReserve(_reserve)

onlyAmountGreaterThanZero(_amount)

{

// Usage of a memory struct of vars to avoid "Stack too deep" errors due to local variables

RepayLocalVars memory vars;

(

vars.principalBorrowBalance,

vars.compoundedBorrowBalance,

vars.borrowBalanceIncrease

) = core.getUserBorrowBalances(_reserve, _onBehalfOf);

...

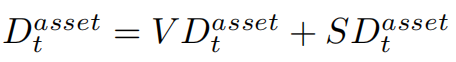

Dassett=债务总额

- D(asset)(t = )Total Debt=债务总额

- 公式

- 说明

- 借入的流动资金总额

- Total amount of liquidity borrowed

- 借入的流动资金总额

- 公式

VDassett=可变债务代币总额

- VD(asset)(t = )Total Variable Debt Tokens=可变债务代币总额

- 说明

- 以债务代币表示的可变利率借入的流动性总额

- Total amount of liquidity borrowed at a variable rate represented in debt tokens

- 以债务代币表示的可变利率借入的流动性总额

- 说明

SDassett=稳定债务代币总额

- SD(asset)(t = )Total Stable Debt Token=稳定债务代币总额

- 说明

- 以债务代币表示的稳定利率借入的流动性总额

- Total amount of liquidity borrowed at a stable rate represented in debt tokens

- 以债务代币表示的稳定利率借入的流动性总额

- 说明

Lassett=资产的总流动性

- L(asset)(t = )Total Liquidity of an asset=资产的总流动性

- 说明

- 资产准备金中可用的流动资金总额。该值的小数取决于货币的小数

- Total amount of liquidity available in the assets reserve. The decimals of this value depend on the decimals of the currency

- 资产准备金中可用的流动资金总额。该值的小数取决于货币的小数

- 说明

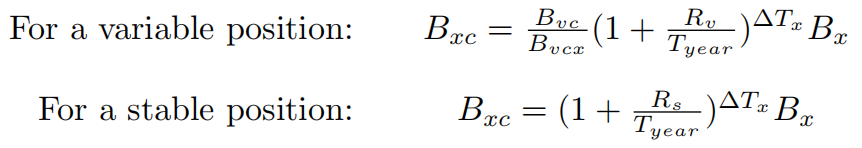

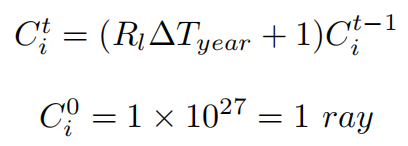

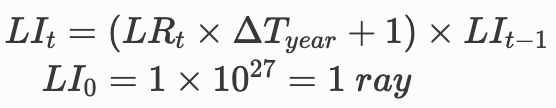

Ci=LIt=流动性累计指数

C(t)(i)=Cumulated liquidity Index=流动性累计指数

- 旧=AAVE v1

- 公式

- 说明

- 准备金在时间间隔∆T期间累积的利息,在发生借款、存款、偿还、赎回、掉期、清算事件时更新。

- Interest cumulated by the reserve during the time interval ∆T , updated whenever a borrow, deposit, repay, redeem, swap, liquidation event occurs

- 准备金在时间间隔∆T期间累积的利息,在发生借款、存款、偿还、赎回、掉期、清算事件时更新。

- 公式

新=AAVE v2

- 公式

- 说明

- 从池子首次发生用户操作时,累计到现在,每单位存款本金,变成多少本金(含利息收入)

- 存储

struct ReserveData { //the liquidity index. Expressed in ray uint128 liquidityIndex; } 更新

function _updateIndexes( DataTypes.ReserveData storage reserve, uint256 scaledVariableDebt, uint256 liquidityIndex, uint256 variableBorrowIndex, uint40 timestamp ) internal returns (uint256, uint256) { uint256 currentLiquidityRate = reserve.currentLiquidityRate; uint256 newLiquidityIndex = liquidityIndex; //only cumulating if there is any income being produced if (currentLiquidityRate > 0) { uint256 cumulatedLiquidityInterest = MathUtils.calculateLinearInterest(currentLiquidityRate, timestamp); newLiquidityIndex = cumulatedLiquidityInterest.rayMul(liquidityIndex); require(newLiquidityIndex <= type(uint128).max, Errors.RL_LIQUIDITY_INDEX_OVERFLOW); reserve.liquidityIndex = uint128(newLiquidityIndex); } reserve.lastUpdateTimestamp = uint40(block.timestamp); } }

- 公式

- 旧=AAVE v1

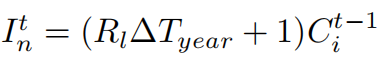

Itn=NIt=归一化收入

- I(t)(n)=reserve Normalized Income=归一化收入

- 含义:每单位存款本金,未来将变成多少本金(含利息收入)

- 旧=AAVE V1

- 公式

- 说明

- 准备金累积的持续利息

- Ongoing interest cumulated by the reserve

- 准备金累积的持续利息

- 公式

- 新=AAVE V2

- 公式

- 公式

- 代码

- getNormalizedIncome

/**

* @dev Returns the ongoing normalized income for the reserve

* A value of 1e27 means there is no income. As time passes, the income is accrued

* A value of 2*1e27 means for each unit of asset one unit of income has been accrued

* @param reserve The reserve object

* @return the normalized income. expressed in ray

**/

function getNormalizedIncome(DataTypes.ReserveData storage reserve)

internal

view

returns (uint256)

{

uint40 timestamp = reserve.lastUpdateTimestamp;

//solium-disable-next-line

if (timestamp == uint40(block.timestamp)) {

//if the index was updated in the same block, no need to perform any calculation

return reserve.liquidityIndex;

}

uint256 cumulated =

MathUtils.calculateLinearInterest(reserve.currentLiquidityRate, timestamp).rayMul(

reserve.liquidityIndex

);

return cumulated;

}